Under the new California law, over the next two years, sanitary pads and baby diapers will not be taxed.

Anyone who has been taxed on diapers or menstrual products since Jan. 1 can request a refund by bringing a receipt to the retailer as well as a copy of a notice from the California Department of Tax and Fee Administration. https://t.co/oPzRHJm9JB

— ASM Jacqui Irwin (@ASM_Irwin) January 8, 2020

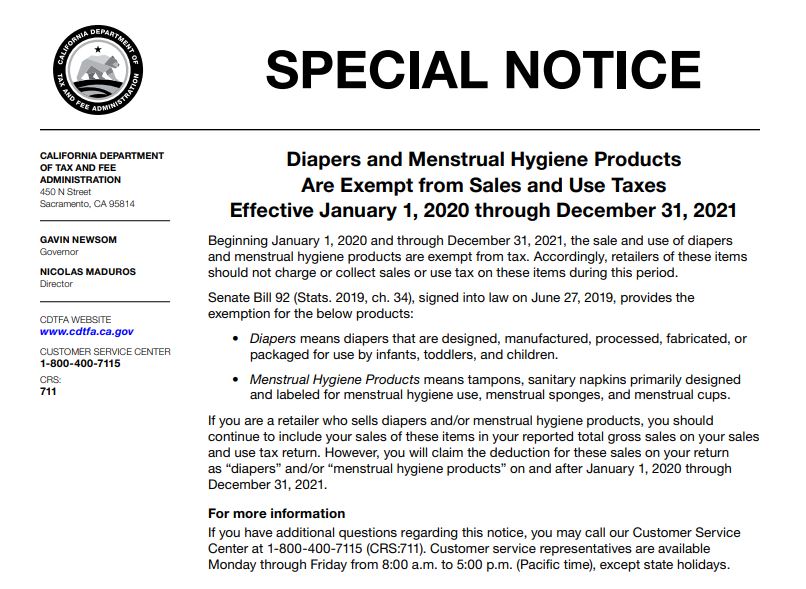

Senate bill No. 92 (SB-92) was signed on 27 June 2019 Governor of California Gavin Newsom. He included the abolition of taxes into the state budget in your state. The law comes into force from now will be valid until 31 December 2021.

According to this law will be granted temporary tax exemptions for the following products:

- Diapers that are «designed, manufactured, processed, and packaged for use by children».

- Feminine products, namely: «tampons, sanitary napkins designed primarily for use during the period of menstruation.»

A new California law that went into effect at the start of 2020 means you’ll no longer have to pay tax on menstrual products and diapers — at least not for the next two years.https://t.co/UtpBILD2yi

— shar jossell (@SharSaysSo) January 8, 2020

It is the result of the efforts of two state lawmakers — the Democratic Assembly of women: Lorena Gonzalez of San Diego and Cristina Garcia of bell gardens, who for years tirelessly fighting to abolish the tax on the sale of diapers and menstrual hygiene.

Their previous efforts, however, were not successful. In 2016, a former Governor Jerry brown vetoed this legislation for financial reasons. But Gonzalez and Garcia continued work on the project.

«This year, thanks to the support of our Governor, we were finally able to cancel the sales tax baby diapers — saving the average family $ 100 a year per child in taxes on diapers, Gonzales said. — We are working hard to make this repeal permanent.»

Anyone who is subject to tax on these products from January 1, you may request a refund by presenting the receipt to the seller, and a copy of the notice from the Department for taxes and levies of California.

Questions may be directed to the customer service center Agency by calling 1-800-400-7115 Monday through Friday from 8 to 17 hours.