Rising rents in new York for the last 8 years is obvious. However, how exactly it happens? For some segments of the population of new York city hardest hit increasing rental rates? What to expect in the future?

A review of the current situation on the market for rental housing in new York city.

The main trends in the growth of real estate prices in new York city in 2018:

- Since 2010, rents in new York rose by an average of 31%. The increase was uneven: in some areas only 15% and others 45%.

- For tenants who paid the rent in 2010 of $2,000 per month, in 2018, this amount will increase by $620 and will be for the year of $7440.

- In neighborhoods where at least 25% of the residents are families with young children, prices were rising by 5 percent faster than in neighborhoods with fewer families.

- Where 50% of the residents had incomes below the average new York rent was increased by 6% faster compared to the neighborhoods in which they live mostly middle-and upper-middle incomes.

If we talk about General trends, January 2010 and January 2018, rental rates in the city increased on average by 31%. However, the results for all 88 neighborhoods in new York vary greatly. The fastest rent growth observed in sparsely populated neighborhoods located on the outskirts of Manhattan and Brooklyn, for example, in the areas of Inwood and Ditmas Park. Here the price of rental housing is initially low in the city. At the same time, in more prosperous areas, where renting an apartment is more expensive, respectively, of rent increases much slower. Thus, in such neighborhoods as Boro Park, Dyker heights, Bensonhurst or Woodstock, the growth in property prices was less than 18% over the past 8 years.

10 neighborhoods with the highest rates of price growth for rental apartments

- Ditmas Park (Brooklyn) — 45%

- Prospect Lefferts Gardens (Brooklyn) — 45%

- Bedford-Stuyvesant (Brooklyn) — 41%

- Crown Heights (Brooklyn) — 39%

- Inwood (Manhattan) — 39%

- Hamilton Heights (Manhattan) — 39%

- Midwood (Brooklyn) — 38%

- Flatbush (Brooklyn) — 38%

- Washington Heights (Manhattan) — 37%

- Brighton Beach (Brooklyn) — 37%

All regions showing high growth in prices for rental property are considered traditional for people with average or below average income levels. Most often it is the neighborhoods of Brooklyn and Upper Manhattan. Most interesting, the majority of these blocks was never in good standing with the tenants. The main advantage was accessibility. As an example, it is better suited to southern Brooklyn, where over the past 10 years, the demand has so increased that the rent rates «skyrocketed», showing a price increase of 43% compared to 2010.

The housing market of the middle class and upper-middle much more stable, but the trend to higher prices are present here. The slowest increase rates for rental properties located in quiet areas of Manhattan. For example, the cost of rent in Dumbo or Riverdale has not changed much over the last 10 years.

10 blocks with a minimum growth of prices for rental apartments

- Ridgewood (Queens) — 15%

- Central Park South (Manhattan) — 16%

- Midtown (Manhattan) — 16%

- Long Island City (Queens) — 18%

- Riverdale (Bronx) — 20%

- Midtown (Manhattan South) — 20%

- Gramercy Park (Manhattan) — 21%

- Upper West Side (Manhattan) — 21%

- Dumbo (Brooklyn) — 21%

- Stuyvesant Town/PCV (Manhattan) — 22%

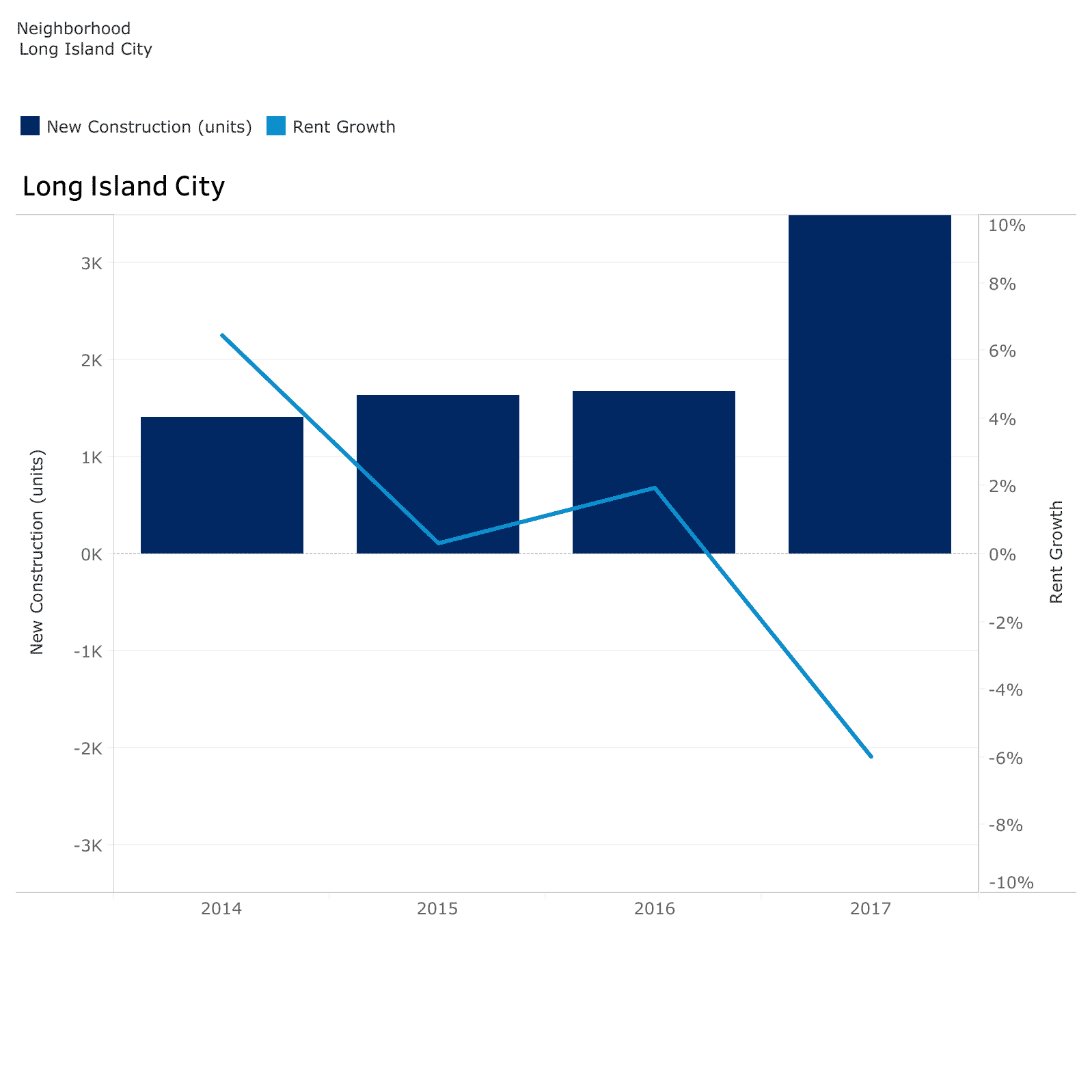

Interesting situation on long island, where apartments rose in price steadily, until 2017, and then began to fall. This can be explained by current construction boom on long island. As a result of active building of housing has increased significantly, and many of the apartments offered now for rent, in 2010, did not exist. So today, here you can find a great one bedroom apartment only $5-10 more expensive than in 2011 (if you bargain).

StreetEasy

Stand out and Ridgewood, Queens, where the rental cost is not only growing much more slowly than the average for new York, but in some cases, even falls in comparison with previous years. To explain this fact can be unnecessarily sharp rental growth in 2011-2012 caused not by objective reasons, and tendencies to speculation on the part of developers and homeowners. It is logical that this situation could not last forever. Today, in these neighborhoods it is possible to find a good apartment with 2 bedrooms at a price 20% lower than was proposed in 2012.

Growth trends from 2008 to 2018

In the period of overcoming the economic crisis in USA in 2008, the cost of renting real estate in new York rose at a moderate pace, with no clear leaders in price growth in the city. However, in 2012 the situation changed: there appeared new trends. Thus, the cost of rent for an apartment in the most accessible neighborhoods of the city began to grow dramatically, while in the more prestigious areas of the Big Apple prices remained relatively stable. By the end of 2014, the gap of the more expensive areas of the city reached 11%, but this is how it turned out, was not the limit.

After coming in the 2014 peak prices for real estate in new York, the rate of increase in the cost of rent decreased across the country. One of the main reasons was started in 2014 the rapid rise of the building. Since then, the volume of rented housing stock annually exceeded the annual average for the previous 10 years. As a result, in 2017 in new York city have donated more than 25 000 units of new housing.

The General situation in new York remains the same — life in the city is steadily going up. However, now it makes sense to think about what kind of housing and in what part of town to rent. Perhaps in the long term profitable to rent property in more prosperous areas than in traditional neighborhoods for people with incomes below the average. Most likely, these trends are long term.

The rise in prices has hit new York families

Let’s compare the situation with 2010. Then the growth of prices for residential real estate far exceeded the pace of increase in property prices of middle and elite levels. The average rent in 2010, ten most quickly growing neighborhoods of new York city was $1695, while in the top ten most stable in terms of prices for rental property areas, this figure was $2800.

The rapid rate of increase in rental costs in cheap areas of the city worst affected the contingent of people living in them, namely families with low income. In 52 districts of new York, inhabited by families with above-average income (2010 — $50 285 per family), rents rose by an average of 26.9% over the past 8 years. For the same period in 31 quarter, the basis of the population which is the population with incomes below the average, rents have increased by 33.1%. What does this increase? And the fact that the family spends in 2010 no more than $2,000 a month on rent, in 2018, to pay more than $1500 a year.

In areas with the highest rate of growth in rents is also home to a large number of families with young children. Compare: rental rate increased by 32% in areas where at least a quarter of the resident population has a minor child on the contents, while in areas with a predominantly adult population — only 27%. In such areas of Manhattan like Midtown, Gramercy Park and the Financial District, less than 10% of the resident population are minors, and the growth of prices for rental housing — one of the lowest in the city. What can be said about Ditmas Park, Elmhurst and University Heights. Here about one third of the population are families, and the level of inflation the highest in the city (about 40%).

The relationship between the social characteristics of the area and the growth in property prices is clear. However, it does not mean that prices increase due to the presence or absence of children, but rather demonstrates the complexity arising in the event of an increase in the cost of rent for a family of new Yorkers.

The price increase is not associated with race

Growing rates for rental property affect almost all parts of the city, regardless of the main contingent of residents. In such areas as Bed-Stuy, Prospect Lefferts Gardens and Flatbush, has always lived a large number of representatives of the «colored» population, and rising rents is one of the highest in the city. If we talk about five blocks-leaders in terms of the rate of increase in rental prices of apartments over the last 8 years, all of them are traditional for living Latin and African Americans. At the same time, there are other notable leaders of price growth: South and Central neighborhoods of Brooklyn: Brighton Beach, Midwood and Sheepshead Bay. Here live mainly white, but the rising rents over the same period the same high. This suggests that the high rate of growth of prices for rental apartments are connected, primarily, with income and geographic location of the residential quarter, not its racial composition.

Low-Rise America

Overall, the analysis shows that the existing program for the conservation of the architectural face of new York and its environs has a big impact on rising rents, affecting most strongly the prices in low-cost areas. The city built many new neighborhoods, but buildings in the predominantly low-rise. Seven of the 10 districts, showing the maximum rate of increase of prices for rental apartments was a policy restriction site and a tall building with the purpose of preserving the historical character and low population density in them. Examples include areas of Midwood and Crown Heights. The General concept of development of the city did not anticipate the extension of their territories. However, the result of such policies was a record growth rate of prices for rental property, as demand clearly exceeded supply.

Nevertheless, over the past two decades, many areas of new York grew. The extension was a strategic step in the development of long island city, Brooklyn and Hudson yards. Three of the 10 areas with the slowest growth in rents in long island city, Dumbo and the Upper West Side was partially reconstructed between 2007 and 2009, which allowed to significantly slow the increase in prices for apartments. Other areas that obtained the right to development, namely: Williamsburg, Downtown Brooklyn, and Chelsea, also occupy lower positions in the chart of growth in rental prices over the past 8 years.

Not only the geographical location of the area affects the increase in prices. The fact that so many areas of new York with the fastest growing rents are most densely populated, reminds us of the fact that prices for rental apartments «increase» and economic growth in the country and operating in the city program for its development. The fact that the construction boom in the city still failed to alleviate the housing crisis in many remote areas, illustrates the complexity of this problem.